Secure Financial Documents, M&A due diligence

In the world of business, mergers and acquisitions (M&A) are common occurrences that

help companies grow and expand their operations. However, when companies merge or

acquire another business, they must conduct due diligence to ensure that they are making

an informed decision and minimizing potential risks. One critical aspect of due

diligence is securing financial documents, which contain sensitive information that

should be protected from unauthorized access.

Securing Financial Documents

Financial documents such as balance sheets, income statements, cash flow statements, and

tax returns contain confidential information about a company's financial performance and

status. Such information is valuable to investors and competitors alike, making it

vulnerable to theft or misuse. If these documents are not handled securely, they can be

accessed by unauthorized individuals who may use the information for malicious purposes

such as identity theft, fraud, or insider trading.

To prevent such scenarios, it is crucial to secure financial documents during the M&A due diligence process. We created HelpRange to help you satisfy this goal, here are some essential steps to follow to ensure the security of financial documents:

To prevent such scenarios, it is crucial to secure financial documents during the M&A due diligence process. We created HelpRange to help you satisfy this goal, here are some essential steps to follow to ensure the security of financial documents:

Limit access to financial documents

Only authorized individuals should have access to financial documents. This includes the

parties involved in the M&A deal and their advisors. Access should be granted on a

need-to-know basis, and all individuals who access the documents should be required to

sign a non-disclosure agreement (NDA) to ensure that they do not disclose the

information to anyone outside of the M&A deal.

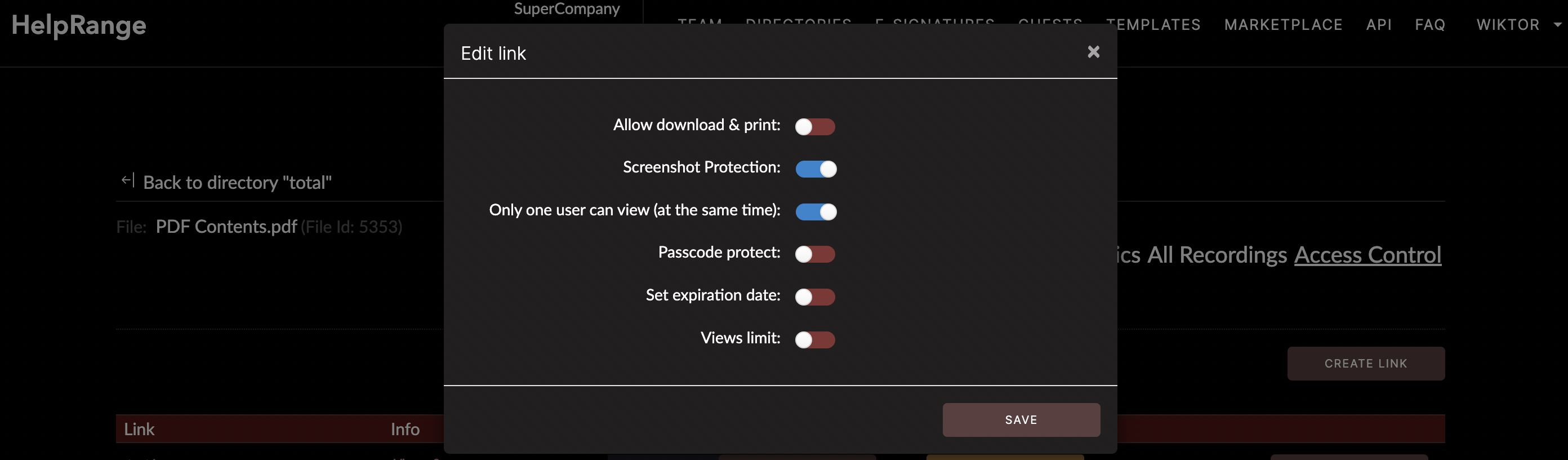

Use secure document sharing tools

Financial documents should be shared using secure document sharing tools that use

encryption to protect data in transit and at rest. Such tools provide an extra layer of

security that ensures that only authorized individuals can access the documents.

Set up document controls

Document controls can be used to limit the usage of financial documents. For example,

you can restrict printing or copying of documents to prevent unauthorized distribution.

Document controls can also be used to monitor who accesses the documents and when,

providing a record of document usage.

Implement data retention policies

It is essential to have data retention policies in place to ensure that financial

documents are not retained longer than necessary. This helps to minimize the risk of

sensitive information falling into the wrong hands. Data retention policies should

specify the length of time that financial documents should be retained and how they

should be securely destroyed when no longer needed.

Track Your Document

You should keep track of who you share your pitch deck with and when. This can help you

identify any unauthorized use or distribution of your pitch deck. You can use tools such

as HelpRange to track who has viewed your document and when.

Conclusion

In conclusion, securing financial documents during M&A due diligence is critical to

protect the sensitive information contained in them. Following the steps outlined above

can help to ensure that financial documents are accessed only by authorized individuals

and protected from unauthorized access, distribution, or retention. By securing

financial documents, companies can minimize the risks associated with M&A deals and make

informed decisions that drive business growth and success.

Check out HelpRange

HelpRange is "Next-Gen Data Room For Documents Protection & Analytics

Platform". HelpRange is a cutting-edge virtual data room platform for document access

controls and in-depth analytics, ensuring superior management and usage insights for

your documents.